What Does Roe Stand for in Business

What is Return on Equity (ROE)?

Return on Equity (ROE) is the measure of a company's annual return (net income Net Income Net Income is a key line item, not only in the income statement, but in all three core financial statements. While it is arrived at through ) divided by the value of its total shareholders' equity Stockholders Equity Stockholders Equity (also known as Shareholders Equity) is an account on a company's balance sheet that consists of share capital plus , expressed as a percentage (e.g., 12%). Alternatively, ROE can also be derived by dividing the firm's dividend growth rate by its earnings retention rate (1 – dividend payout ratio Dividend Payout Ratio Dividend Payout Ratio is the amount of dividends paid to shareholders in relation to the total amount of net income generated by a company. Formula, example ).

Return on Equity is a two-part ratio in its derivation because it brings together the income statement and the balance sheet Balance Sheet The balance sheet is one of the three fundamental financial statements. The financial statements are key to both financial modeling and accounting. , where net income or profit is compared to the shareholders' equity. The number represents the total return on equity capital and shows the firm's ability to turn equity investments into profits. To put it another way, it measures the profits made for each dollar from shareholders' equity.

Return on Equity Formula

The following is the ROE equation:

ROE = Net Income / Shareholders' Equity

ROE provides a simple metric for evaluating investment returns. By comparing a company's ROE to the industry's average, something may be pinpointed about the company's competitive advantage Competitive Advantage A competitive advantage is an attribute that enables a company to outperform its competitors. It allows a company to achieve superior margins . ROE may also provide insight into how the company management is using financing from equity to grow the business.

A sustainable and increasing ROE over time can mean a company is good at generating shareholder value Shareholder Value Shareholder value is the financial worth owners of a business receive for owning shares in the company. An increase in shareholder value is created because it knows how to reinvest its earnings wisely, so as to increase productivity and profits. In contrast, a declining ROE can mean that management is making poor decisions on reinvesting capital in unproductive assets.

ROE Formula Drivers

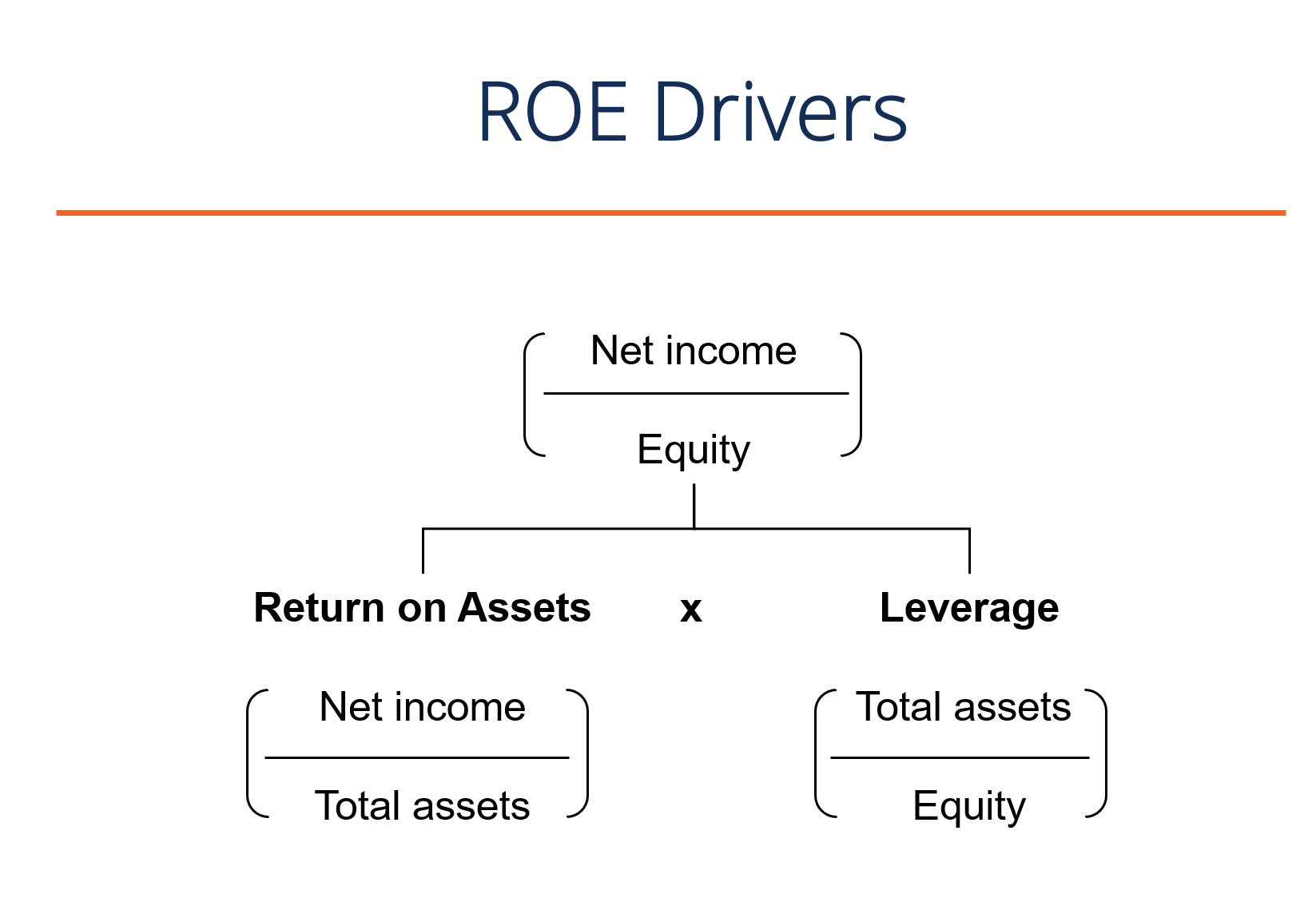

While the simple return on equity formula is net income divided by shareholder's equity, we can break it down further into additional drivers. As you can see in the diagram below, the return on equity formula is also a function of a firm's return on assets (ROA) Return on Assets & ROA Formula ROA Formula. Return on Assets (ROA) is a type of return on investment (ROI) metric that measures the profitability of a business in relation to its total assets. and the amount of financial leverage Financial Leverage Financial leverage refers to the amount of borrowed money used to purchase an asset with the expectation that the income from the new asset will exceed the cost of borrowing. it has. Both of these concepts will be discussed in more detail below.

Learn more in CFI's Financial Analysis Fundamentals Course.

Download the Free Template

Enter your name and email in the form below and download the free template now!

Return on Equity Template

Download the free Excel template now to advance your finance knowledge!

Why is ROE Important?

With net income in the numerator, Return on Equity (ROE) looks at the firm's bottom line to gauge overall profitability for the firm's owners and investors. Stockholders are at the bottom of the pecking order of a firm's capital structure Capital Structure Capital structure refers to the amount of debt and/or equity employed by a firm to fund its operations and finance its assets. A firm's capital structure , and the income returned to them is a useful measure that represents excess profits that remain after paying mandatory obligations and reinvesting in the business.

Why Use the Return on Equity Metric?

Simply put, with ROE, investors can see if they're getting a good return on their money, while a company can evaluate how efficiently they're utilizing the firm's equity. ROE must be compared to the historical ROE of the company and to the industry's ROE average – it means little if merely looked at in isolation. Other financial ratios Financial Ratios Financial ratios are created with the use of numerical values taken from financial statements to gain meaningful information about a company can be looked at to get a more complete and informed picture of the company for evaluation purposes.

In order to satisfy investors, a company should be able to generate a higher ROE than the return available from a lower risk investment.

Effect of Leverage

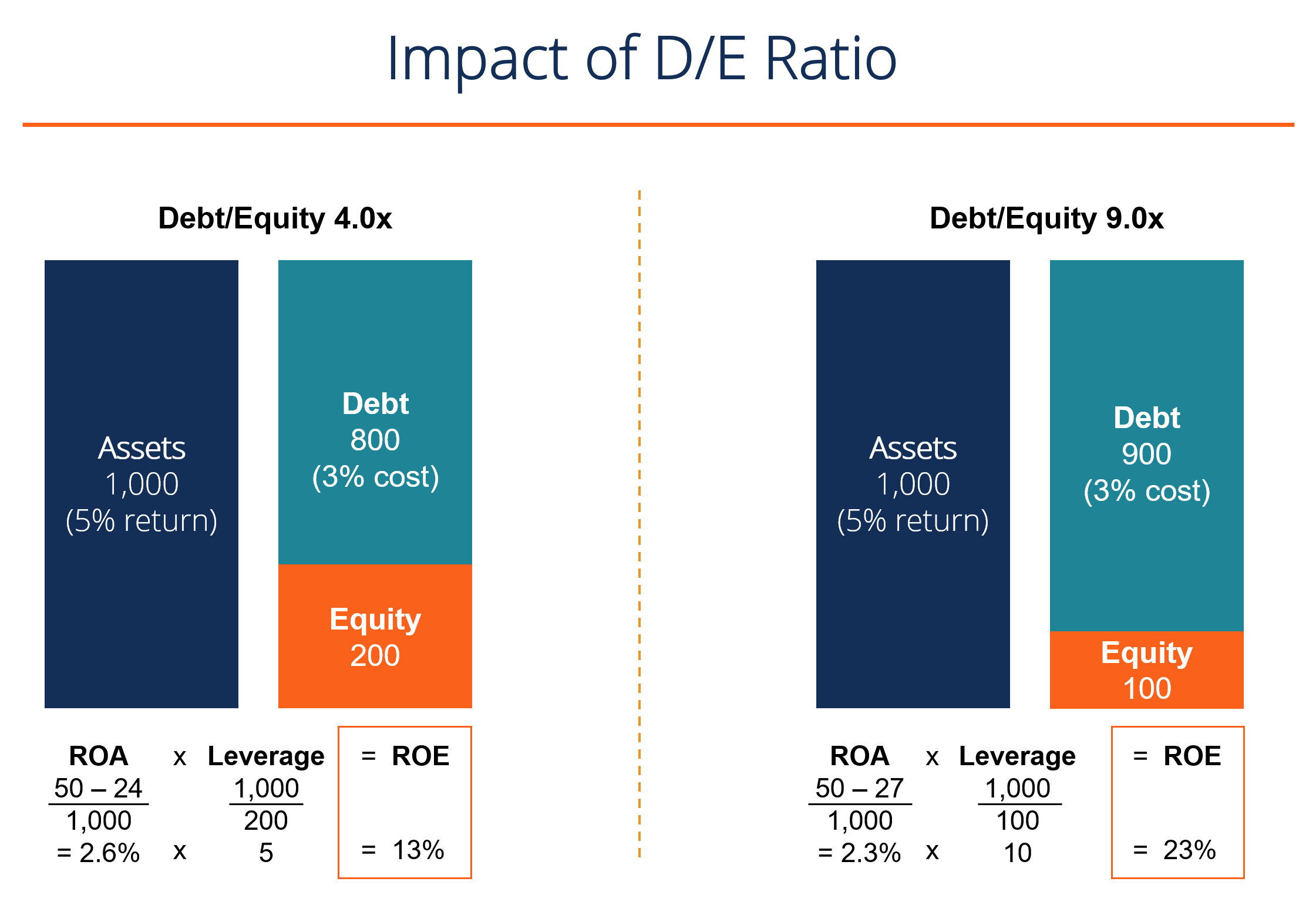

A high ROE could mean a company is more successful in generating profit internally. However, it doesn't fully show the risk associated with that return. A company may rely heavily on debt Long Term Debt Long Term Debt (LTD) is any amount of outstanding debt a company holds that has a maturity of 12 months or longer. It is classified as a non-current liability on the company's balance sheet. The time to maturity for LTD can range anywhere from 12 months to 30+ years and the types of debt can include bonds, mortgages to generate a higher net profit, thereby boosting the ROE higher.

As an example, if a company has $150,000 in equity and $850,000 in debt, then the total capital employed is $1,000,000. This is the same number of total assets employed. At 5%, it will cost $42,000 to service that debt, annually. If the company manages to increase its profits before interest to a 12% return on capital employed (ROCE) Return on Capital Employed (ROCE) Return on Capital Employed (ROCE), a profitability ratio, measures how efficiently a company is using its capital to generate profits. The return on capital , the remaining profit after paying the interest is $78,000, which will increase equity by more than 50%, assuming the profit generated gets reinvested back. As we can see, the effect of debt is to magnify the return on equity.

The image below from CFI's Financial Analysis Course shows how leverage increases equity returns.

Learn more in CFI's Financial Analysis Fundamentals Course.

Drawbacks of ROE

The return on equity ratio can also be skewed by share buybacks Dividend vs Share Buyback/Repurchase Shareholders invest in publicly traded companies for capital appreciation and income. There are two main ways in which a company returns profits to its shareholders – Cash Dividends and Share Buybacks. The reasons behind the strategic decision on dividend vs share buyback differ from company to company . When management repurchases its shares from the marketplace, this reduces the number of outstanding shares Weighted Average Shares Outstanding Weighted average shares outstanding refers to the number of shares of a company calculated after adjusting for changes in the share capital over a reporting period. The number of weighted average shares outstanding is used in calculating metrics such as Earnings per Share (EPS) on a company's financial statements . Thus, ROE increases as the denominator shrinks.

Another weakness is that some ROE ratios may exclude intangible assets from shareholders' equity. Intangible assets Intangible Assets According to the IFRS, intangible assets are identifiable, non-monetary assets without physical substance. Like all assets, intangible assets are non-monetary items such as goodwill Goodwill In accounting, goodwill is an intangible asset. The concept of goodwill comes into play when a company looking to acquire another company is , trademarks, copyrights, and patents. This can make calculations misleading and difficult to compare to other firms that have chosen to include intangible assets.

Finally, the ratio includes some variations on its composition, and there may be some disagreements between analysts. For example, the shareholders' equity can either be the beginning number, ending number, or the average of the two, while Net Income may be substituted for EBITDA EBITDA EBITDA or Earnings Before Interest, Tax, Depreciation, Amortization is a company's profits before any of these net deductions are made. EBITDA focuses on the operating decisions of a business because it looks at the business' profitability from core operations before the impact of capital structure. Formula, examples and EBIT EBIT Guide EBIT stands for Earnings Before Interest and Taxes and is one of the last subtotals in the income statement before net income. EBIT is also sometimes referred to as operating income and is called this because it's found by deducting all operating expenses (production and non-production costs) from sales revenue. , and can be adjusted or not for non-recurring items Non-Recurring Item In accounting, a non-recurring item is an infrequent or abnormal gain or loss that is reported in the company's financial statements. .

How to Use Return on Equity

Some industries tend to achieve higher ROEs than others, and therefore, ROE is most useful when comparing companies within the same industry. Cyclical industries tend to generate higher ROEs than defensive industries, which is due to the different risk characteristics attributable to them. A riskier firm will have a higher cost of capital and a higher cost of equity.

Furthermore, it is useful to compare a firm's ROE to its cost of equity Cost of Equity Cost of Equity is the rate of return a shareholder requires for investing in a business. The rate of return required is based on the level of risk associated with the investment . A firm that has earned a return on equity higher than its cost of equity has added value. The stock of a firm with a 20% ROE will generally cost twice as much as one with a 10% ROE (all else being equal).

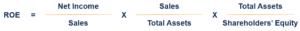

The DuPont Formula

The DuPont formula DuPont Analysis In the 1920s, the management at DuPont Corporation developed a model called DuPont Analysis for a detailed assessment of the company's profitability breaks down ROE into three key components, all of which are helpful when thinking about a firm's profitability. ROE is equal to the product of a firm's net profit margin, asset turnover, and financial leverage:

DuPont Analysis In the 1920s, the management at DuPont Corporation developed a model called DuPont Analysis for a detailed assessment of the company's profitability

DuPont Analysis In the 1920s, the management at DuPont Corporation developed a model called DuPont Analysis for a detailed assessment of the company's profitability

If the net profit margin increases over time, then the firm is managing its operating and financial expenses well and the ROE should also increase over time. If the asset turnover increases, the firm is utilizing its assets efficiently, generating more sales per dollar of assets owned. Lastly, if the firm's financial leverage increases, the firm can deploy the debt capital to magnify returns. DuPont analysis is covered in detail in CFI's Financial Analysis Fundamentals Course.

Video Explanation of Return on Equity

Below is a video explanation of the various drivers that contribute to a firm's return on equity. Learn how the formula works in this short tutorial, or check out the full Financial Analysis Course!

Caveats of Return on Equity

While debt financing can be used to boost ROE, it is important to keep in mind that overleveraging has a negative impact in the form of high interest payments and increased risk of default Debt Default A debt default happens when a borrower fails to pay his or her loan at the time it is due. The time a default happens varies, depending on the terms agreed upon by the creditor and the borrower. Some loans default after missing one payment, while others default only after three or more payments are missed. . The market may demand a higher cost of equity, putting pressure on the firm's valuation Valuation Principles The following are the key valuation principles that business owners who want to create value in their business must know. Business valuation involves the . While debt typically carries a lower cost than equity and offers the benefit of tax shields Tax Shield A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owed. The value of these shields depends on the effective tax rate for the corporation or individual. Common expenses that are deductible include depreciation, amortization, mortgage payments and interest expense , the most value is created when a firm finds its optimal capital structure that balances the risks and rewards of financial leverage.

Furthermore, it is important to keep in mind that ROE is a ratio, and the firm can take actions such as asset write-downs Impairment The impairment of a fixed asset can be described as an abrupt decrease in fair value due to physical damage, changes in existing laws creating and share repurchases Share Repurchase A share repurchase refers to when the management of a public company decides to buy back company shares that were previously sold to the public. A company may decide to repurchase its sharesto send a market signal that its stock price is likely to increase, to inflate financial metrics denominated by the number of shares outstanding (e.g., earnings per share or EPS), or simply because it wants to increase its own equity stake in the company. to artificially boost ROE by decreasing total shareholders' equity (the denominator).

Additional resources

This has been CFI's guide to return on equity, the return on equity formula, and pro/cons of this financial metric. CFI is a provider of the Financial Modeling & Valuation Analyst (FMVA)™ designation Become a Certified Financial Modeling & Valuation Analyst (FMVA)® CFI's Financial Modeling and Valuation Analyst (FMVA)® certification will help you gain the confidence you need in your finance career. Enroll today! . To keep learning and expanding your financial analyst skills, see these additional valuable CFI resources:

- Return on Assets (ROA) Return on Assets & ROA Formula ROA Formula. Return on Assets (ROA) is a type of return on investment (ROI) metric that measures the profitability of a business in relation to its total assets.

- Guide to EBITDA EBITDA EBITDA or Earnings Before Interest, Tax, Depreciation, Amortization is a company's profits before any of these net deductions are made. EBITDA focuses on the operating decisions of a business because it looks at the business' profitability from core operations before the impact of capital structure. Formula, examples

- Cash Flow Guide Valuation Free valuation guides to learn the most important concepts at your own pace. These articles will teach you business valuation best practices and how to value a company using comparable company analysis, discounted cash flow (DCF) modeling, and precedent transactions, as used in investment banking, equity research,

- Financial Modeling Best Practices Free Financial Modeling Guide This financial modeling guide covers Excel tips and best practices on assumptions, drivers, forecasting, linking the three statements, DCF analysis, more

What Does Roe Stand for in Business

Source: https://corporatefinanceinstitute.com/resources/knowledge/finance/what-is-return-on-equity-roe/